A long-awaited Apple Pay feature is finally on your iPhone

Later last year, when it unveiled iOS 16 at WWDC 2022, Apple launched Apple Pay. As of right now, “randomly selected consumers” are starting to receive the capability via a beta version of Apple Pay Later in the Wallet app. You’ll need iOS 16.4 and iPadOS 16.4 to access this prerelease version, which should have been sent to your Apple ID account.

This is a beta version of Apple Pay Later; the full service will be made available to eligible iPhone users in the United States who are older than 18 in the “coming months.”

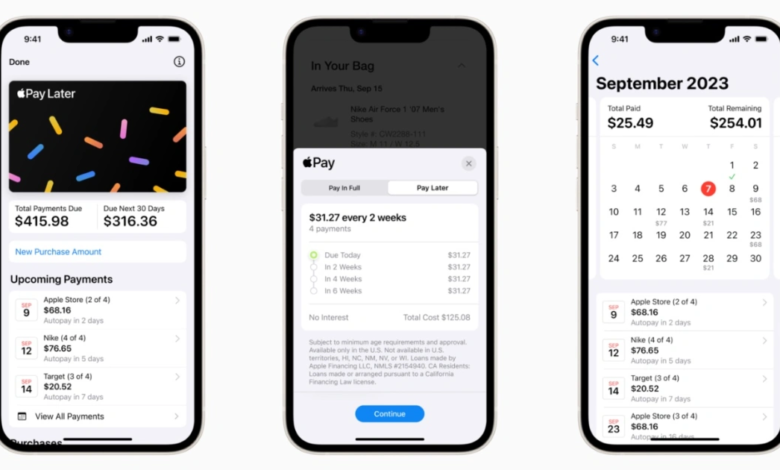

With the new Apple Pay Later financing option, eligible consumers in the US can divide the cost of an Apple Pay purchase into four equal payments over the period of six weeks. These payments do not include any additional fees or interest. Loan amounts with Apple Pay Later can range from $50 to $1,000. While using Apple Pay on your iPhone or iPad, you can utilize Apple Pay Later once it has been approved to make online and in-app purchases.

Eligible US consumers can split the cost of an Apple Pay purchase into four equal payments over the course of six weeks with the new Apple Pay Later financing option. There are no additional charges or interest included in these payments. With Apple Pay Later, you may borrow anything from $50 to $1,000. Once Apple Pay Later has been accepted, you can use it to make online and in-app purchases while using Apple Pay on your iPhone or iPad.

Similar to Apple Card, Apple Pay Later is immediately incorporated into the Wallet app. Users of Apple Pay Later may therefore access, manage, and track all of their loans from a single location. To ensure that you don’t forget a payment, the Wallet app also allows you to view forthcoming transactions on a calendar and can notify you of them by email or the Wallet app. For the loan repayment option, credit cards are not permitted; thus, debit cards must be attached.