What Is Decentralized Finance and Why Should You Care?

Discover how Decentralized Finance revolutionizes finance with blockchain, eliminating banks for peer-to-peer lending, trading & earning.

Decentralized Finance (DeFi) is transforming the global financial system by replacing traditional banks and institutions with blockchain-powered, peer-to-peer alternatives. Unlike conventional finance, which relies on centralized control, DeFi operates on open, permissionless networks, allowing anyone with an internet connection to access financial services like lending, borrowing, and trading without intermediaries. Built on smart contracts, DeFi platforms offer transparency, lower fees, and greater financial freedom—making it a revolutionary force in the way we manage money. But why should you care? Because DeFi has the potential to democratize finance, giving individuals full control over their assets while unlocking new opportunities for wealth generation.

The rise of Decentralized Finance (DeFi) marks a pivotal shift in economic systems, challenging the dominance of traditional banking. By eliminating middlemen, reducing transaction costs, and increasing accessibility, DeFi empowers users worldwide particularly the unbanked and underbanked. Whether you’re an investor seeking higher yields, a tech enthusiast exploring blockchain innovations, or simply someone curious about the future of money, understanding DeFi is essential. As this financial revolution gains momentum, it’s reshaping everything from payments to investments, making it one of the most significant developments in modern finance.

What Is Decentralized Finance and Why Should You Care?

What Is DeFi?

DeFi, short for Decentralized Finance, refers to a blockchain-based financial system that operates without traditional intermediaries like banks, brokers, or insurance companies. Instead, it relies on smart contracts—self-executing agreements written in code to facilitate transactions on decentralized networks, primarily Ethereum. These smart contracts automate processes such as lending, borrowing, trading, and yield farming, making financial services more efficient and accessible.

How Does DeFi Work?

DeFi applications (DApps) are built on blockchain networks, with Ethereum being the most prominent due to its smart contract capabilities. These DApps interact with each other through interoperable protocols, creating a seamless financial ecosystem. For example, a user can deposit cryptocurrencies into a lending platform like Aave, earn interest, and then use those funds to trade on a decentralized exchange (DEX) like Uniswap—all without leaving the blockchain.

Key Benefits of DeFi

Financial Inclusion

DeFi opens up financial services to anyone with an internet connection, removing barriers like geography, credit history, or minimum balance requirements.

Lower Costs

By cutting out intermediaries, DeFi reduces fees associated with banking, remittances, and trading.

Programmable Money

Smart contracts enable automated financial services, reducing human error and increasing efficiency.

User Control

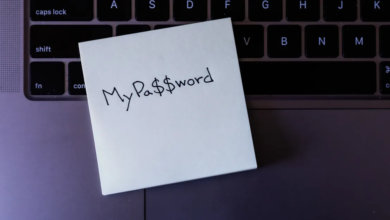

Unlike traditional banks, where institutions control funds, DeFi users retain full ownership of their assets via private keys.

Risks and Challenges

Despite its advantages, DeFi is not without risks. Smart contract vulnerabilities can lead to hacks, as seen in high-profile exploits like the Poly Network exploit and DAO hack. Additionally, the lack of regulation means there’s little recourse if something goes wrong. Market volatility, impermanent loss in liquidity pools, and regulatory uncertainty also pose significant challenges.

Why Should You Care About DeFi?

Financial Freedom Without Intermediaries

Decentralized Finance eliminates banks and institutions from financial transactions, giving you direct control over your assets. With DeFi, you can lend, borrow, or trade without needing approval from centralized authorities. Smart contracts automate processes securely, reducing human error and manipulation. This shift empowers individuals to manage wealth independently, free from traditional banking restrictions.

Global Access to Financial Services

DeFi operates on blockchain networks, making financial tools available to anyone with an internet connection. Nearly 1.7 billion people remain unbanked worldwide DeFi bridges this gap by offering permissionless access to loans, savings, and investments. Unlike traditional systems, there are no geographic barriers or minimum balance requirements. This democratization of finance could uplift entire economies by fostering inclusion.

Higher Earnings Through Yield Opportunities

Traditional savings accounts offer minimal interest, but DeFi platforms provide competitive yields through lending and liquidity mining. By staking crypto or providing liquidity, users can earn passive income far exceeding conventional returns. While risks exist, informed participation in DeFi protocols can significantly grow wealth. For investors, this presents an alternative to stagnant traditional markets.

Transparent and Tamper-Proof Systems

Every DeFi transaction is recorded on public blockchains, ensuring full transparency and auditability. Unlike opaque banking systems, DeFi protocols operate with open-source code that anyone can verify. This reduces fraud and corruption while building trust in financial operations. Users can track funds in real time without relying on third-party assurances.

Innovation Driving the Future of Finance

DeFi is pioneering concepts like programmable money, flash loans, and decentralized autonomous organizations (DAOs). These innovations are reshaping industries beyond banking, including insurance, real estate, and governance. Early adopters gain exposure to cutting-edge technologies that could define tomorrow’s economy. Ignoring DeFi risks missing out on the next wave of financial evolution.

Protection Against Inflation and Censorship

DeFi’s decentralized nature makes it resistant to government overreach or inflationary monetary policies. Cryptocurrencies like Bitcoin and stablecoins offer alternatives to fiat currencies vulnerable to devaluation. Additionally, no central authority can freeze or seize assets in a truly decentralized system. For those in unstable economies, DeFi provides a safeguard for preserving wealth.

Interoperability and Composability

DeFi protocols are designed to work together seamlessly, allowing users to mix and match services like “money Legos.” This interoperability enables complex financial strategies across multiple platforms without intermediaries. Composability fosters rapid innovation, as developers can build on existing protocols. The result is an ever-expanding ecosystem of customizable financial tools.

Challenges and Risks to Consider

While DeFi offers immense potential, it’s not without risks like smart contract vulnerabilities, impermanent loss, and regulatory uncertainty. The space remains experimental, with high volatility and potential for scams. Education and cautious participation are essential to navigate this landscape safely. The rewards can be substantial, but they require informed risk management.

Why It Matters Now

DeFi isn’t just a niche trend it’s redefining the global financial infrastructure. As institutions and governments begin integrating blockchain solutions, early understanding positions you ahead of the curve. Whether for profit, sovereignty, or curiosity, engaging with DeFi today prepares you for the economy of tomorrow. The question isn’t whether DeFi will impact finance, but how quickly you’ll adapt to its possibilities.

Read More: Beyond Bitcoin: 7 Real Blockchain Uses Changing the World

Conclusion

DeFi (Decentralized Finance) represents a groundbreaking shift in the financial industry, offering a more open, transparent, and accessible alternative to traditional banking. By leveraging blockchain technology and smart contracts, DeFi eliminates intermediaries, reduces costs, and empowers users with full control over their assets. While challenges like security risks and regulatory uncertainty persist, the potential for financial inclusion and innovation makes DeFi a pivotal development in the modern economy.

As the DeFi ecosystem matures, it will likely integrate further with traditional finance, bridging the gap between centralized and decentralized systems. Whether you’re an investor, developer, or simply someone interested in the future of money, understanding DeFi is essential. The financial landscape is changing rapidly, and those who embrace this evolution early stand to benefit the most from the decentralized revolution.

FAQs

What is Decentralized Finance in simple terms?

DeFi (Decentralized Finance) is a blockchain-based financial system that operates without banks, using smart contracts to automate transactions like lending, borrowing, and trading.

Is Decentralized Finance safe to use?

While Decentralized Finance offers transparency and control, it carries risks like smart contract hacks and scams. Users should research platforms thoroughly before investing.

How do I start using Decentralized Finance?

To use DeFi, you need a cryptocurrency wallet (like MetaMask), some crypto assets (e.g., ETH), and access to a DeFi platform such as Uniswap or Aave.

Can Decentralized Finance replace traditional banks?

DeFi has the potential to disrupt traditional banking, but widespread adoption depends on regulatory clarity, scalability, and improved security.

What are the best Decentralized Finance platforms?

Popular DeFi platforms include Uniswap (DEX), Aave (lending), Compound (borrowing), and MakerDAO (stablecoins). Always do your own research before investing.